For much of 2025, the narrative around electric vehicles in the US was cautious, even pessimistic. But beneath the headlines, something very different was happening. According to a new industry report from Paren, the US DC fast-charging sector didn’t slow down at all. It accelerated.

Fast-charging networks added more than 18,000 new DC fast-charging ports in 2025, a sharp jump from the roughly 14,000 added in 2024. Even more striking was the finish: Q4 2025 alone saw nearly 5,800 new ports deployed, the strongest quarter on record and far beyond expectations. This wasn’t speculative overbuilding — utilization rates held steady nationwide, meaning drivers were actually using the new chargers as fast as they were being installed.

For everyday EV users, these numbers matter. More ports don’t just mean more dots on a map; they mean shorter waits, more reliable road trips, and less anxiety for drivers who can’t charge at home. As ride-share drivers, delivery fleets, and apartment dwellers increasingly rely on public fast charging, infrastructure is quietly becoming a utility rather than a novelty.

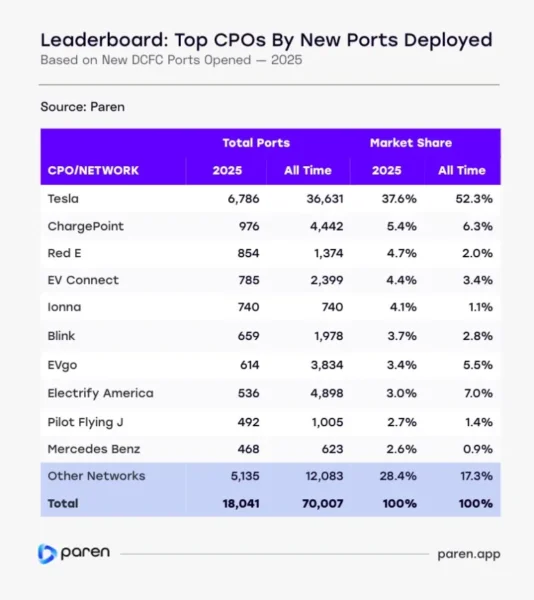

The growth also reshaped the competitive landscape. Tesla remained the single largest player, adding nearly 6,800 Supercharger ports. But its share of new deployments fell below 40% as the broader ecosystem expanded even faster. New and OEM-backed networks scaled rapidly, while dozens of smaller operators collectively doubled their contribution year over year.

Perhaps the most important signal is where the momentum came from. Much of the expansion was driven by private capital, not federal stimulus. That suggests confidence — not hype — is powering the buildout. Charging providers are seeing enough real demand to justify continued investment.

In my view, the fast-charging data exposes a disconnect between EV sentiment and EV reality. While debates swirl around adoption curves, drivers are voting with their charging sessions. Infrastructure isn’t racing ahead of demand anymore — it’s finally keeping up.